Editor-in-Chief

Ohio Wesleyan’s tuition will increase 3.5 percent next year from $38,890 to $40,250, according to a Jan. 29 announcement from Dan Hitchell, vice-president of finance and administration and treasurer.

Hitchell said the increase is a result of rising fixed costs like lights, heat, power, facility and technological maintenance, and library expenses.

“Even when we’re aggressive in cost containment, some things will go up and cost more,” he said. “You walk around a college campus and it’s like running a small city.”

According to Hitchell, the rise is low compared to other Great Lakes College Association (GLCA) institutions—the highest rates of increase as a percentage of current tuition are around 5 percent, while the lowest are around 3.

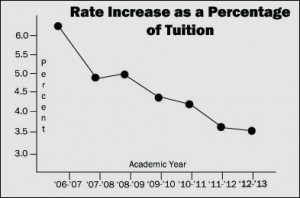

OWU’s rate of increase has declined 3.2 percent since the 2006-2007 fiscal year, from 6.2 percent.

Tuition for the current year is the cheapest of the Ohio Five—OWU, Denison University, Kenyon College, Oberlin College and the College of Wooster—but is the sixth-most expensive of the thirteen GLCA schools. Earlham College ranks just above OWU, with a tuition cost of $39,200.

Sophomore Ibrahim Saeed said he thinks the university “hasn’t really given a proper explanation” of the increase.

“It was so strange, and there are a lot of things that go unexplained,” he said. “But sometimes you don’t want to argue with it because it is what it is.”

Saeed said his expenses as an international student, in addition to tuition, have increased—the rate for his health insurance went from $1,000 to $1,500 since the 2011-2012 year.

University President Rock Jones said the President’s Office makes an annual report of “the needs for the upcoming year” and “the expenses related to those needs” to the Board of Trustees, which ultimately determines tuition rates.

Jones said salaries and benefits for faculty and staff also contribute to growth in expenses, which the university is trying to keep down, along with the aforementioned fixed costs.

“We’re trying to be as energy-efficient as we can,” he said. “We’re trying to look at ways to use purchasing to make the least expensive acquisitions, but still have the quality of materials that we need. A couple of years ago we had significant reductions in administrative staff as a way to hold down cost. We’ve not had significant program budget increases in recent years.”

Hitchell said one way to cut costs is to evaluate which staff duties—accounting tasks, for example—can be automated and completed more efficiently.

This allows “higher order” jobs to be done faster without hiring new employees.

He said this kind of “creativity,” rather than “cost containment” alone, is what the university will need to keep tuition from increasing at a higher rate.

“Cost containment means we’re going to just spend less,” he said. “Creativity means we’re going to spend better and achieve more with what we spend.”

Jones said the university attempts to offset increases with financial aid, the budget for which is “much larger than it was six or eight years ago.”

One reform to the financial aid system has been an increase in the amount awarded through Schubert scholarships for prospective honors students.

Recipients receive a base amount of annual scholarship money and get a chance to earn more at one of two competitions early in the spring semester.

The base funding for the class of 2015 was $17,000 per year; the class of 2016 saw an increase to $22,500. The former’s Schubert funding didn’t increase with tuition. Jones said this was because the program had been changed to have a larger base amount and less additional money from the competition.

Saeed said he thinks the university administration should adjust aid for current students to assuage the tuition increase.

“I think if they’re going to increase tuition like that, they should increase other things, like increase our scholarships,” he said.

Despite such reforms, Jones said he thinks the university will need to keep rates of increase for tuition low in the coming years.

“I think that families are doing all they can, and we have to be careful to not push tuition too high,” he said. “We have to balance the increases in aid against the increases in tuition, so reducing the increase in tuition also increases the amount of additional aid money that’s available.”

Hitchell said he thinks keeping increases down is essential to the “mission” of schools like OWU.

“The challenge for higher ed is going to be how we deliver that mission and accomplish more with what we do spend,” he said.

Saeed said he wonders what the future of tuition will look like at OWU if increases continue.

“It’s weird, because when you’re a sophomore you think, ‘What am I going to be paying my senior year? What are the freshmen going to be paying their senior year? If my kids go here are they gonna be paying 80,000 a year?’” he said.